LIFE

Find coverage that’s right for you and your love ones!

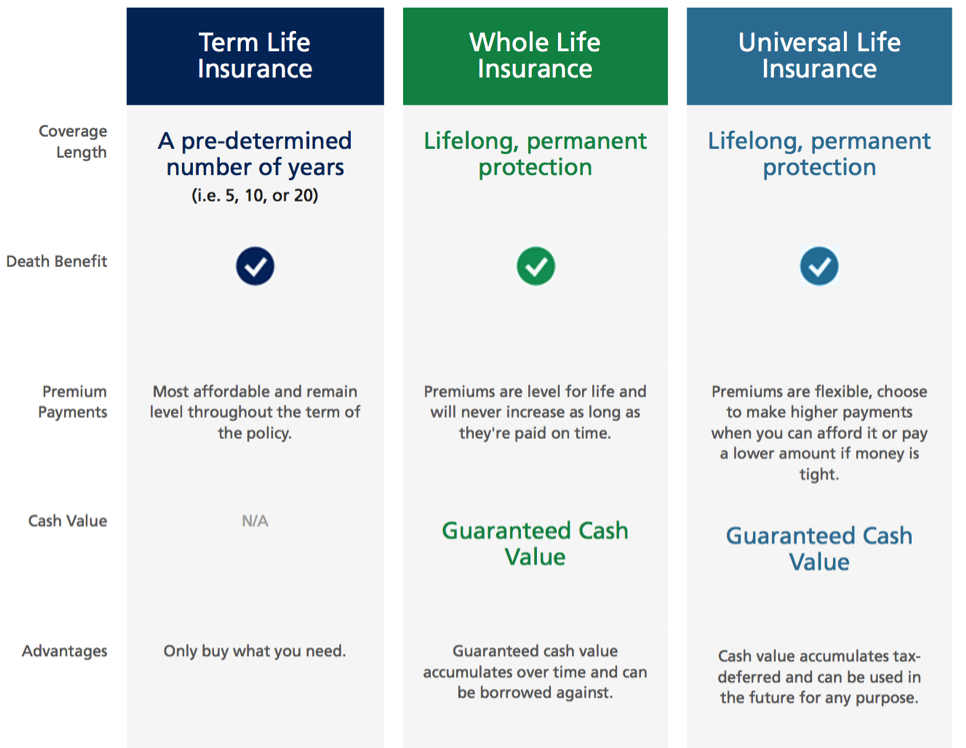

Term life, whole life and universal life insurance plans have one sure thing in common: Each type pays a death benefit when the covered person passes away. The money can be used by heirs to replace income, pay off debts, leave a legacy, etc. But the three types can differ in terms of coverage length, premium flexibility, cash value accumulation and distribution, and other factors.

It’s impossible to say which type of life insurance is better because the kind of coverage that’s right for you depends on your unique circumstances and financial goals.

But remember, the best way to figure out the amount and type of life insurance that makes sense for your particular situation is to meet with a qualified life insurance professional from Thank God Insurance… 😉

LIFE INSURANCE QUOTE

Who needs life insurance?

What type of life insurance is right for me?

There are three major types of non-variable life insurance coverage:

- Term life insurance–the most affordable type–is designed to pay a benefit if the insured person dies during a certain time period, such as 5, 10 or 20 years. Term life insurance is best when your need is limited to a set time period, such as the duration of your mortgage or until you retire. The coverage lasts only as long as the policy stipulates.

- Whole life insurance is permanent protection to cover you, literally, for your whole life. The coverage includes many guarantees. Premiums are guaranteed level and will never increase for the life of the contract as long as premiums are paid on time. Whole life insurance comes with guaranteed cash value, which accumulates over time and can be borrowed against.

- Universal life insurance is another permanent form of life insurance. Premiums are flexible, so you can choose to make higher payments when you can afford it or pay a lower amount if money is tight. Universal life insurance also has a cash value, which accumulates tax deferred. You can access your cash value in the future for any purpose.

Term life, whole life and universal life insurance plans have one sure thing in common: Each type pays a death benefit when the covered person passes away. The money can be used by heirs to replace income, pay off debts, leave a legacy, etc. But the three types can differ in terms of coverage length, premium flexibility, cash value accumulation and distribution, and other factors. To determine which type of life insurance is best for you, talk to your Thank God Life insurance agent, who will listen to your concerns, understand your needs and recommend the right solution for you.

How much life insurance do I need?

Life insurance is an important component of any financial plan. As you consider how much life insurance you truly need, ask:

- How much income does my family need if I die today?

- What types of debts or other expenses need to be paid when I pass away?

- These may include your mortgage, final expenses (such as funeral costs, probate charges, costs of settling your estate) and any other debt, such as credit card and car loan balances.

- How much do I have set aside for savings?

- Do I have any existing life insurance policies?